What is CSRD?

The CSRD is the new standard which will affect around 50,000 EU companies will have to report their climate and environmental impact.

This new regulation updates previous corporate sustainability reporting requirements under the 2014 Non-Financial Reporting Directive (NFRD) which will be familiar to come companies. CSRD builds upon NFRD and is much more ambitious, with the information reported through NFRD was seen as insufficient by the European Commission.

Who needs to comply?

CSRD will apply to the following:

- Large companies – even ones that are based outside of the EU. That meet the following criteria:

- €40 million in net turnover.

- €20+ million in assets.

- 250+ employees.

- Non-EU companies with a net turnover of €150 million in the EU, and with atleast one subsidiary or branch in the EU.

- Small and Medium Enterprises (SMEs) will come into scope further down the line, indicating the need for strategy development and implementation now.

Even if your company does not fall into scope, it is important to be aware of the CSRD reporting requirements. It is likely that you may still see increased pressure to report in line with CSRD, as stakeholders seek to understand the links between sustainability and wider business risks and opportunities.

This is an EU directive, how could this affect you in the UK?

Non-EU companies (including EU subsidiaries of a UK parent company) that operates in the EU could also fall within the scope of CSRD reporting. As well as a UK company, whose parent company operates within the EU.

You may be required to provide sustainability disclosure if:

- Net turnover generated in the EU (either at consolidated or individual level) exceeds €150 million for the last two consecutive financial years.

- There is at least one subsidiary in the EU, or an EU branch has an annual net turnover exceeding €40 million in the previous financial year.

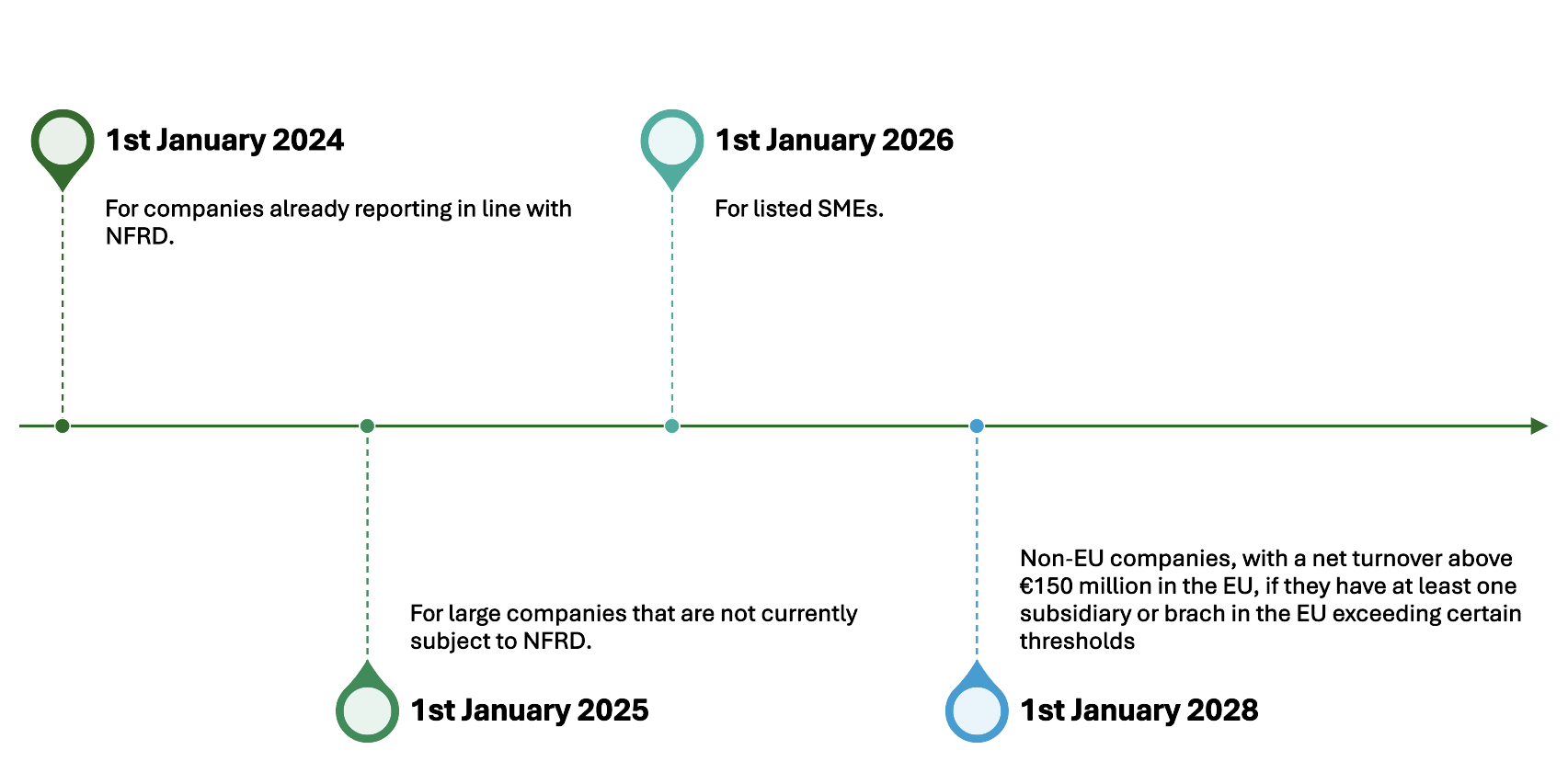

When must you comply by?

Compliance for CSRD reporting is being phased in starting from 2024 to 2029, and is based NFRD legacy and company size.

- 1 January 2024 – for companies already reporting in line with NFRD (reporting in 2025 on 2024 data).

- 1 January 2025 – for large companies that are not currently subject to NFRD (reporting in 2026 on 2025 data).

- 1 January 2026 – for listed SMEs (reporting in 2027 on 2026 data).

- 1 January 2028 – Non-EU companies, with a net turnover above €150 million in the EU, if they have at least one subsidiary or brach in the EU exceeding certain thresholds (outlined above) (reporting in 2029 on 2028 data).

Scope of reporting requirements

Under NFRD companies will already be reporting:

- Environmental.

- Social responsibility.

- Human rights.

- Anti-corruption and bribery.

- Board diversity.

Additional reporting requirements under CSRD includes:

- Double materiality: sustainability risks affecting the company and companies’ impact on society and the environment.

- Forward-looking qualitative and quantitative information including targets and progress.

- Information relating to intangibles: social, human and intellectual capital.

- Reporting in line with Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy.

Starting in 2025, CSRD will mandate that businesses have a Paris Agreement-aligned emissions reduction plan to reach net zero by 2050.

What are the benefits of CSRD?

CSRD reporting is going to need additional time and resource to understand and embed as part of your operations. However, rather than seeing it as a mandatory requirement, there are benefits for your company:

- Strategic opportunity.

- Reduces the risk of greenwashing, and will provide clarity for external stakeholders.

- Enhanced credibility.

- Enhances your due diligence and risk management.

- Better strategic insights.

What are your next steps?

You and your company should start taking action now, to prepare and be ready for the next steps. Firstly, you need to:

- Understand whether your company will be affected by these new regulations, and when is your compliance date. This way you can work out what timeframes you are working towards.

- Gap analysis on what you currently report versus what you are going to have to report under the CSRD.

- Review your sustainability and carbon targets. Ensure they are robust, and in line with the correct methodology.

- Educate employees on CSRD.